About us

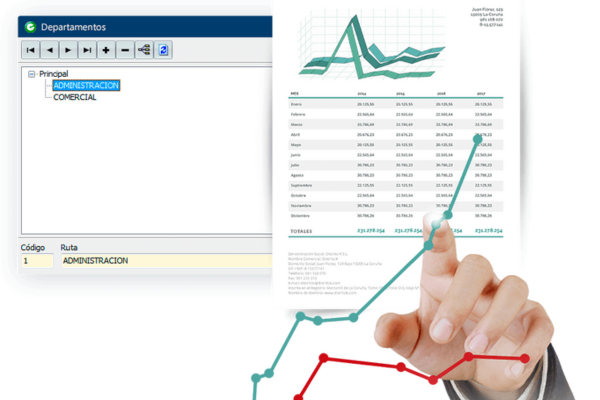

MGCS

Founded in 1994.

- Fully committed to our clients and employees, we carry out our operations through our central values: Compromise, honesty, adaptability, and respect.

- As a result of our multicultural team and continuous updating, our main clients are foreign companies that establish legal entities in Mexico. We advise them with the necessary processes for them to comply with their obligations before the Law.

- Several years of experience in the field have helped us identify our clients’ main needs and adapt to them, always aiming to facilitate the decision-making process and the best business development.

- A qualified and specialized team advises each of our clients on the different MGCS areas of expertise.

- In a globalized world, MGCS acts always looking for the resource’s efficiency, playing its part: Think globally, act locally.